These short-term choices come on top of a deeper challenge. The UK economy has been stuck in a cycle of sluggish growth for several years. Productivity continues to lag behind other advanced economies, business investment remains weak, and political uncertainty has weighed heavily on business confidence. So, what does the latest BCC economic forecast show?

BCC Forecast has upgraded growth expectations for 2025

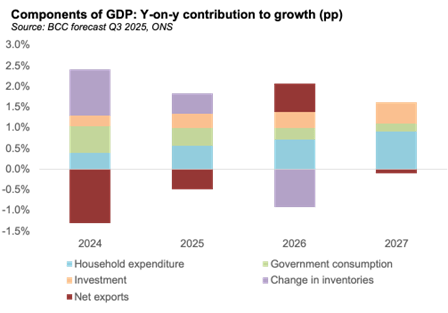

Our latest forecast released last week, has revised up UK growth to 1.3% in 2025 from 1.1% last quarter, reflecting stronger-than-expected activity in Q1, with growth in the first half of the year supported by public spending (Figure 1). However, despite the short-term uplift, the UK outlook remains weak, weighed down by persistent inflationary pressures, and ongoing global and domestic uncertainties. GDP growth is projected to remain unchanged from the previous forecast at 1.2% in 2026 and 1.5% in 2027.

Figure 1: Public spending is the main source of growth this year

Business investment is now projected to grow by just 1.6% in 2025, a significant downgrade from 4.8% in the last forecast. The previous forecast followed ONS data at the time, which suggested stronger Q1 investment, but this has since been revised down to levels more in line with weak business sentiment. BCC surveys also show that rising costs, particularly the national insurance increase, have further weighed on firms’ investment plans. Investment is forecast to then edge up to 1.9% in 2026 and recover to 3% in 2027.

Export growth is forecast to remain modest as businesses remain wary of global uncertainties and persistent trade frictions. Exports are expected to pick up from 2% last quarter to 3.1% in 2025, rising slightly to 3.3% in 2026 before easing to 3.2% in 2027. This improvement is reflective of stronger than expected performance in Q1 ahead of the introduction of US tariffs.

Given ongoing geopolitical tensions, inflationary pressures are set to persist, with headline CPI expected to peak at 3.7% this year, before starting to fall back in 2026 and 2027. Given persistent upward pressures on prices, the bank rate is expected to remain at 4% by the end of this year, with only two further cuts anticipated by the end of 2026 as the Bank remains cautious about persistent inflation.

Recent employment growth has so far proven to be robust, but the overall labour market picture is less clear, with unemployment rising and vacancies falling. However, momentum is expected to weaken, with the unemployment rate forecast to rise to 4.7% in 2025 and remain elevated into 2026, reflecting softer hiring intentions and tighter business conditions.

BCC’s growth forecast aligns with BoE and NIESR projections in 2025

The latest forecasts from the Bank of England (BoE) and NIESR are closely aligned with the BCC outlook for UK GDP growth in 2025, with all projecting growth of around 1.3% (Figure 2).

However, beyond 2025, the outlook begins to diverge slightly. The BCC expects GDP to rise by 1.2% in 2026, which remains in line with NIESR, before a modest pick-up to 1.5% in 2027. NIESR turns more pessimistic for 2027, forecasting growth of just 1.1%. The BoE is slightly more optimistic, forecasting 1.3% in 2026 before an uptick to 1.5% in 2027. By contrast, the Office for Budget Responsibility (OBR) remains an outlier, projecting much stronger growth of 1.9% in 2026 and 1.8% in 2027.

Figure 2: BCC growth forecast for 2025 aligns with BoE and NIESR at 1.3%

Domestic and international challenges weight on UK outlook

The UK economy faces a mix of domestic and international challenges that are weighing on confidence and growth prospects. On the domestic policies side, increases in NICs and NLW have come into effect, but have had limited impact on employment thus far with the economic implications to be seen later in the year. Labour costs have increased in the presence of resilient wage growth, contributing to decreasing business confidence, with potential impacts on business investment and hiring.

At the same time, the fiscal outlook remains weak. Sluggish growth, stalled legislation, and a deteriorating budget position have fuelled expectations that tax increases may be announced later in the year. This uncertainty is affecting both businesses and households, who are holding back on spending and investment in anticipation of tighter fiscal policy.

As companies navigate the complexities of shifting trade policies, heighted uncertainty affects business investment and planning. Heightened geopolitical tensions – from the conflicts in Gaza, Israel, and Syria – are keeping energy markets and global supply chains under strain. Additionally, UK–EU trade frictions continue to complicate cross-border business activity, while progress on a US–UK trade deal has yet to provide meaningful economic relief. UK goods exports to the US have fallen to their lowest level in three years, with tariffs on steel and aluminium goods still unresolved.

What UK businesses need to grow?

Businesses need the right confidence and certainty to invest and grow. The upcoming Autumn Budget will be an important moment to provide that stability. The BCC is calling for no further tax rises on businesses and greater support to unlock investment and safeguard growth. Our recently published Blueprint for Growth document offers Government practical ways forward, to help businesses invest, recruit and trade more effectively.

The Government must also be prepared to respond to unexpected economic shocks. The combination of fragile global supply chains, heightened geopolitical tensions, and persistent inflationary pressures leaves the UK economy exposed to volatility. Clear policies that support business adaptability will be critical in ensuring that shocks do not further derail the UK’s already fragile growth trajectory.